However, what the people of the country have been witnessing is the blame game between the Central government and State governments. Though the public sector oil marketing companies reduced the prices of petrol and diesel by one paisa per litre recently, the prices had risen again, especially after the metropolitan cities like Mumbai and New Delhi found it difficult to stem the rot.

Sources in the political circle admit that till the conclusion of the assembly elections in Karnataka this year, efforts were made not to increase the prices of petrol and diesel for political considerations. However, the present Union Government led by the Prime Minister Narendra Modi, has to incur the wrath of the public for persisting with high fuel taxes, owing to rise in the global prices of crude oil in the recent months. The Centre is naturally anxious to create a positive impact among the people on this sensitive issue, bearing in mind the coming Assembly election to Rajasthan, Madhya Pradesh, Mizoram and Chhattisgarh, let alone creating a viable impact for the Lok Sabha elections, slated for April/May, next year.

in Karnataka this year, efforts were made not to increase the prices of petrol and diesel for political considerations. However, the present Union Government led by the Prime Minister Narendra Modi, has to incur the wrath of the public for persisting with high fuel taxes, owing to rise in the global prices of crude oil in the recent months. The Centre is naturally anxious to create a positive impact among the people on this sensitive issue, bearing in mind the coming Assembly election to Rajasthan, Madhya Pradesh, Mizoram and Chhattisgarh, let alone creating a viable impact for the Lok Sabha elections, slated for April/May, next year.

It is being learnt that several formulations are likely to be under consideration to soften the blow to the consumers, including an inclination to revert to an old method, such as asking oil companies to bear the burden to some extent, if not to a great extent. However, there is a disinclination to consider the option of reducing excise duties, as for the alarming reason that it has been raised nine times between November 2014 and January 2016, when global crude oil prices had gone down considerably. It is in this context that Kerala’s decision to slash the sales tax on fuel changed the narrative of the debate, as other States like the God’s own country, have also been earning revenue from oil without any discomfort.

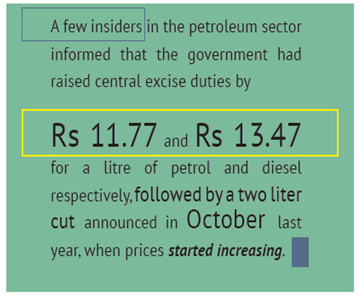

A few insiders in the petroleum sector informed that the government had raised central excise duties by Rs 11.77 and Rs 13.47 for a litre of petrol and diesel respectively, followed by 2 Rupees a litre cut announced in October last year, when prices started increasing. Additionally, a large number of States imposed ad valorem duties on fuel products, which rose as high as 39.27 per cent in Maharashtra with an average of about 26 per cent. In this context, higher prices mean generating more tax revenue for such States. Adding fuel to the fire; the states were also expected to levy value-added tax on the fuel price, inclusive of central excise duties, but excluding the base price. With the result, it took the extreme step of double-taxation, which further necessitated price amplification. For instance, an indepth SBI research report reckons that prices could go down for diesel by Rs 3.75 and petrol by Rs 5.75, a litre, if only the tax-on-tax that included-price structure is being fixed in a phased manner. Some economic experts are of the opinion that sacrificing the money that is available from a hand-shaking distance would be a herculean task for any State or Central government, but the recent robust collections from GST should embolden both the Centre and States to withstand the torrid poundings.

It is being felt in economic circle that rising crude prices only escalates inflation and the trade deficit, thereby mounting pressure on the rupee and GDP growth. The industry has warned that domestic oil pricing policies are hurting the initial recovery, as global rating agencies have already started downplaying India’s growth expectations for this calendar year by citing the oil issue. It may be recalled that in 2016, the Petroleum and Natural Gas Minister, Dharmendra Pradhan said that the government was raising excise duties to protect the consumers from direstraits. The strange explanation articulated by the concerned minister then was that the consumers could be in a prisoner of indecision mind, if exposed to low prices and feel that the problem being compounded when prices shoot-up in due course. The moot point, however, is that the people’s crave for the reduction of high taxes on fuel has fallen on deaf ear.

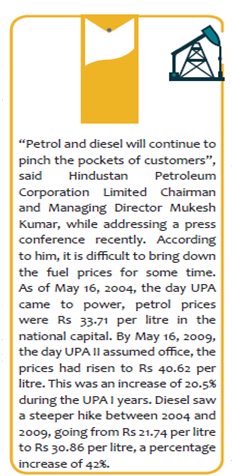

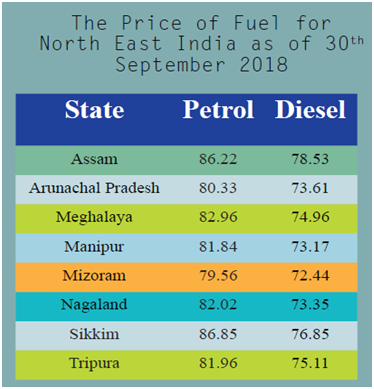

There was a time when the cost of petrol crossed well above Rs 80 in various cities and diesel was oscillating around Rs 73. Though, the crude prices witnessed a marginal reduction and the retail fuel prices was reduced to some extent in the recent past, but this upward trend would not have occurred, had it not been for a huge increase in international oil price. Moreover, the retail price, according to informed sources was also impacted by high domestic tax rates. A few expert commentators on the subject opine that on June 16, 2017, dynamic fuel was introduced in India. With the introduction of the new system, the oil marketing companies like Indian Oil Corporation, Hindustan Petroleum and Bharat Petroleum revised the retail selling prices of petrol and diesel almost every day, unlike in the yesteryear, where prices changed only every fortnight. It was also implied that under dynamic pricing, the prices are subject to fluctuation every day, based on the international oil prices, the currency exchange rate and demand-supply situation in the market.

was oscillating around Rs 73. Though, the crude prices witnessed a marginal reduction and the retail fuel prices was reduced to some extent in the recent past, but this upward trend would not have occurred, had it not been for a huge increase in international oil price. Moreover, the retail price, according to informed sources was also impacted by high domestic tax rates. A few expert commentators on the subject opine that on June 16, 2017, dynamic fuel was introduced in India. With the introduction of the new system, the oil marketing companies like Indian Oil Corporation, Hindustan Petroleum and Bharat Petroleum revised the retail selling prices of petrol and diesel almost every day, unlike in the yesteryear, where prices changed only every fortnight. It was also implied that under dynamic pricing, the prices are subject to fluctuation every day, based on the international oil prices, the currency exchange rate and demand-supply situation in the market.

K.V.Venugopal

To read the further article please get your copy of Eastern Panorama March issue @http://www.magzter.com/IN/Hill-Publications/Eastern-Panorama/News/ or mail to contact @easternpanorama.in