PMC Bank and the fate of its account holders…

Enforcement Directorate or ED has identified and recovered movable and immovable properties and assets worth Rs 3830 Crore owned by HDIL and its promoters /directors of PMC.

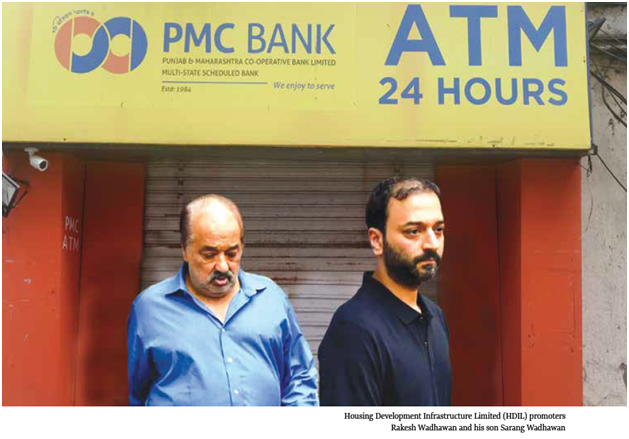

Who are the Promoters of HDIL?

The promoter of HDIL is the former chairman of PMC Banks and rest is the scam.

Punjab and Maharashtra Co-operative Bank, PMC bank, fewer people are aware of this bank in the eastern part of country. The cooperative banks are formulated for the social welfare of society, not for profit maximization, the ideology behind creating a co-operative bank.

PMC bank is the largest urban cooperative bank to be placed under the RBI watch since 2001. PMC bank was founded in the year 1984 in a single room from a single branch currently the bank touched 137 branches across six states Maharashtra, Delhi, Karnataka, Goa, Gujarat, Andhra Pradesh, and Madhya Pradesh.

What went wrong for such a bank which started with a modest outlook?

PMC bank recently suspended Managing Director and Chief Executive Officer (CEO), Mr. Joy Thomas, after they admitted in a “confession letter “ to RBI that the actual exposure to HDIL is over Rs 6,500 crore – four times the regulatory cap as prescribed.

The financials of PMC bank showed as on 31-March 2019, Net profit of Rs 99.69 core, NPA only 2.19%. A bank earning profit as well as the NPA under control went doldrums.

Auditors have not highlighted the fact of loan exposure of Rs 6500 crore, which is, in fact, a massive regulatory weakness.

Let’s understand the insight ….

The relationship between PMC Bank and HDIL ( Housing Development Infrastructure Ltd) dates back in the year 1986. In the year 2012, the HDIL group started to face a liquidity crunch, one reason was the cancellation of their big project in Mumbai and HDIL failed to give dues to all banks and gradually story started unfolding.

PMC banks being in good relation with the HDIL group for a long time hide NPAs and did not report to RBI.

J. Thomas, the suspended Managing Director and CEO of PMC banks informed ED during interrogation that he was acting on the instruction of promoters Rakesh and Sarang Wadhawan and former PMC Bank Chairman Mr. Waryam Singh to hide the bank’s bad debts given to HDIL Group from regulators and portrayed a rosy picture.

The investigations have also revealed that Mr.Waryam Singh, diverted funds from the bank and used them to buy various properties in Punjab, Haryana, and Himachal Pradesh.

Mr. Singh has purchased a five-star hotel in Punjab from the ill-gotten money of PMC Bank, the EOW investigations have revealed. Moreover, he has property worth Rs.2,500 crore near Juhu beach, the police have alleged. The current cost of the five-star hotel is Rs 400/- to Rs 500 crore. Frontman is being used for the said transaction by Mr.Singh.

Wadhawan have already given their consent to auction their property. Consent has been received for 18 attached properties; it will be auctioned at 'fair market value' without any legal hassle. While the total deposit is around Rs.11,000 crore, Rs.3,500 crore, is the value of the attached properties.

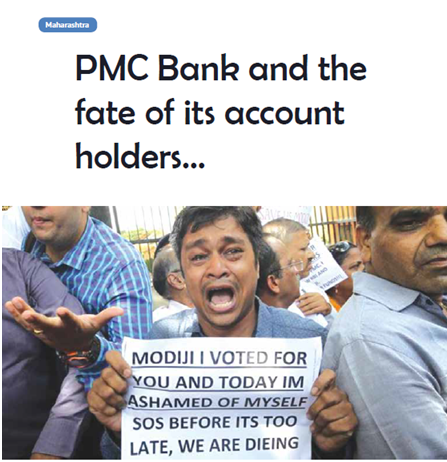

The PMC Bank has been put under restrictions by the RBI after an alleged fraud of Rs 4,355 crore, the scam came to light following which the deposit withdrawal was initially capped at Rs 1000, causing panic and distress among depositors.

Subsequently, the withdrawal limit was raised to Rs 40,000 by the Reserve Bank of India (RBI). But this is of little consequence as 80% (9300 cr) of the deposits in PMC Bank is in Fixed Deposits (FD) as per their annual report for 2018-19.

It’s alarming for Indian Financial System if proper checkpoints don’t work in the form of proactive mode. Most of the instances for cooperative bank failure are not happening without long term notices.

Cooperative Banks are opened for weaker section of people. Are these banks not playing a major role in the overall financial developments and contribution of the economy?

To read the further articles please get your copy of Eastern Panorama November issue @http://www.magzter.com/IN/Hill-Publications/Eastern-Panorama/News/ or mail to contact @easternpanorama.in